How to manage your bills in this economy

Are you feeling overwhelmed by the rising bills in Nigeria’s tough economy? You are not alone. We cannot give in to the economy’s whims or sit around and pray things change, but we can take necessary actions to cope with the situation and live better. This article provides six practical steps to take control of your finances and manage your bills effectively. Come along.

Understanding the current economic situation

Nigeria is a multi-ethnic and culturally diverse country of 36 autonomous states and the Federal Capital Territory, estimated to have a population of 223 million people as of 2024, making it one of the most populous countries in Africa. But this does not help our case. Nigeria continues to face social and economic challenges like insecurity, insurgency, rising poverty, and infrastructural deficiencies.

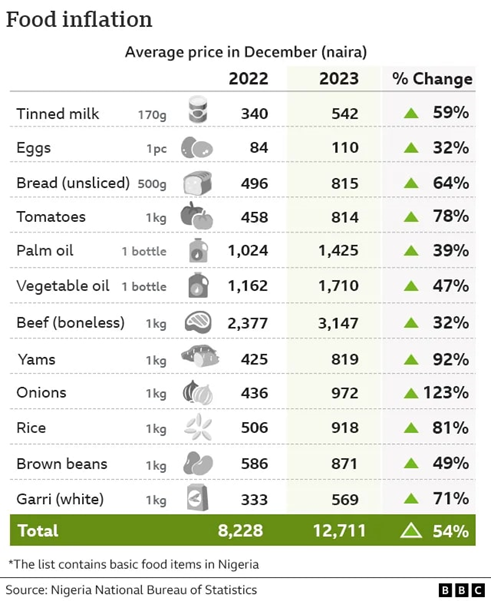

Overall, the annual inflation which refers to the average rate at which prices go up is now close to 30% – the highest figure in nearly three decades, and the cost of food has risen even more by 35%. Many are going hungry, rationing what food they have and opting for cheaper, often unhealthier alternatives. While these are ongoing, the naira is fluctuating, corruption is rubbed in our faces, energy crises are threatening to cripple business and all we can do is watch our bills rise to the rooftops before our very eyes.

The image below shows the food inflation in the country between 2022 and 2023 and its percentage change.

This is just the tip of the iceberg. So what do we do to stay afloat all these and manage our bills more effectively?

Step-by-Step Guide to Managing Your Bills

1. Create a budget

This is the first step to managing your bills. If you didn’t have a budget before this moment, this is a call to create one for yourself with immediate alacrity. What budgeting does is that it helps you set spending limits on various essentials you can’t do without like:

- Food

- Shelter

- Clothing

- Healthcare, etc.

Budgeting helps you to understand how much money is coming in and going out each month and forces you to track your expenses and identify areas where you have been overspending.

2. Track your expenses

This is the period where you become that intentional person you’ve always wanted to be. What do I mean? If you will take hold of your financial situation and overcome the billing flood threatening to overwhelm you, you must be a watchman tracking every expense you make or intend to make. It should be your full-time job. In doing this, it is easier to create a realistic budget for yourself, prevent new debt because you are aware of your spending limits, and identify patterns in your spending behavior.

3. Prioritize your bills

After tracking your expenses, distinguish between your needs and wants. Prioritize your essential bills like rent, utilities, and groceries to ensure you allocate enough funds for them to avoid late fees and penalties. You wouldn’t want to be on the verge of homelessness when you realize that your wardrobe revamp last week could have played a part in paying the bills. If your wants are that important, you need to ply the route of setting aside money gradually for them while ensuring your necessities do not suffer. In the end, it’s a win-win for all involved.

4. Cut unnecessary expenses

Cutting unnecessary expenses helps you prevent the need to incur debt to cover essential bills. You, however, need to determine expenses that fall into this category. It is also the point where you practice saying NO to unnecessary billing. Some common examples of this include:

- Eating out frequently

- Unused subscriptions and memberships

- Impulse purchases and splurging

- Expensive brands or luxury items

- The acquaintance who only remembers you when they are neck deep in debt, and many more.

5. Increase your earning power

This is a no-brainer. While the labor union and the government are still battling on what the new minimum wage should be, your focus should be on increasing your ability to earn more, whether at your place of work or as a freelancer. How do you increase your earnings you ask? There are several things you can do:

- Seek career advancements: excel at your current job by taking on additional responsibilities, completing projects efficiently, and demonstrating leadership qualities. With this, you can negotiate better pay and express your interest in promotions and raises.

- Develop multiple streams of income: explore freelancing gigs, entrepreneurship, monetizing hobbies and talents, and creating passive income through investment opportunities in stocks, real estate, etc.

- Upskilling and reskilling: the more value you can create, the higher the chances of increasing your earning power in any organization. You can enroll in courses or workshops that enhance your skills or teach new ones.

- Networking and building professional relationships: join professional associations and attend industry events to network with others in your field. This can lead to job opportunities, partnerships, and business ventures.

5. Use the Lifestyle App

Imagine this: you have app A where you do your budgeting; app B where you record your expenses; and app C for paying your bills. By the time you go through this routine of apps throughout the month, you are most likely to lose the discipline, motivation, and enthusiasm you started this journey with. But there is a better way. The Lifestyle app!

The lifestyle app helps you create a system for managing your bills. From budgeting to expense tracking, bill prioritization, and all bill payments, it provides a single unified platform where you can get all these done whilst having a complete and comprehensive view of your financial situation at each point in time. No more app switching and your watchman job just became easier. How do you get it? Join the waitlist today and be notified as soon as we launch.

In addition to all I have mentioned above, as a bonus, for a start, I’ll recommend reading Smart Money Women (the book and the movie) by Arese Ugwu and The Richest Man in Babylon by George S. Clason to brush up on your financial literacy skills.

In this article, we have discussed six practical steps for staying afloat in the current economic situation. However, you must remember that these steps mentioned above are not one-off strategies; they are actions you need to perform as often as needed with as much intentionality as you can muster. By so doing, you will be well on your way to managing your bills effectively despite the Nigerian economy. Until next time, join the waitlist, like, and share this article with that friend who needs to see this. Adios✌.